For adding new product the following field are mandatory

- Name

- SKU

- Kind

- Type

- Unit of Measure

- Selling Prices

- Default Affected Accounts

- Reorder Levels

- Purchasing Info

- Website Module

SKU

A stock keeping unit (SKU) is a store's or catalog's

product and service identification code, often portrayed as a machine-readable

bar code that helps the item to be tracked for inventory. A stock keeping unit

(SKU) does not need to be

assigned to physical products in inventory.

Details of product

In that we are giving the following details of the product as following

Type/Form

In that we giving type of product whether it is (Slab,Tile,Block,Cut-to-size,Sink)

Category/Nature

In that we giving category of product whether it is (Granite,Marble,Sandstone,Natural stone)

Base Colors

The base color is used to define the color of product like Black, Brown, Blue, Honey, Gold

Origin

In that we are giving the location of the product from where it will come or produced .

Thickness

The thickness gives the details about the product size because the product can be produced in different thickness like 2cm, 5cm etc.

Unit of measure

GL Account

A general ledger (GL)

is a chronological accounting record a business uses to keep track of

financial transactions. Transactions are categorized and summarized into

general ledger accounts. An account is a unique record for each type of asset, liability,

equity, revenue and expense. The number and type of accounts that make up the

general ledger is determined by the chart of accounts (COA).

GL Income Account

The

income statement accounts are also known as temporary accounts since the

balances in these accounts will be closed at the end of the accounting year.

Each income statement account is closed in order to begin the next accounting

year with a zero balance.

GL Cost Account

Cost accounting is a

process of collecting, recording, classifying, analyzing, summarizing,

allocating and valuating various alternative courses of action & control

the cost. Its goal is to advise the management on the most appropriate course

of action based on the cost efficiency and capability.

Selling Prices

Selling Prices is used to define the different-different prices for single product according to the customer like Dealers Distributor Fabricator all have different- different price list

Reorder Levels

Safety Stock

Buffer inventory to account for uncertainty due to fluctuations in demand or lead time. Higher Safety Stock can be used to boost the on time service rate to your customers.

Reorder

The point at which you order additional raw materials or inventory.

Lead Time

The amount of time from when you place an order with your vendor, to the time it is delivered to you. This includes the transportation time.

Purchasing Info

The activity of acquiring goods or services to accomplish the goals of an organization.

The major objectives of purchasing are to

(1) maintain the quality and value of a company's products,

(2) minimize cash tied-up in inventory,

(3) maintain the flow of inputs to maintain the flow of outputs,

(4) strengthen the organization's competitive position.

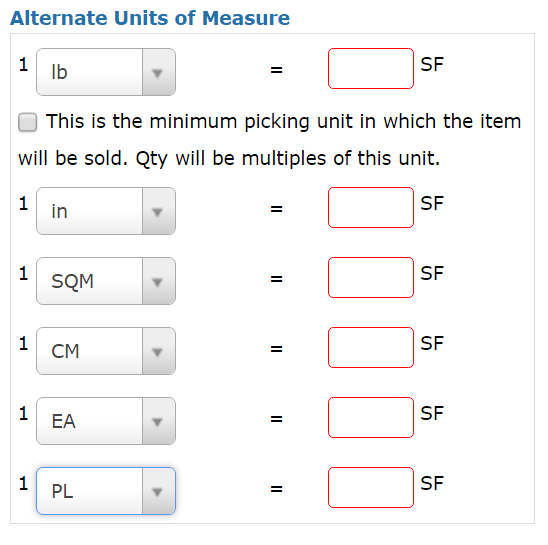

Alternate Units of Measure

This gives the user the ability to record quantities in different unit amounts, depending on the circumstances. For example, you might purchase a raw material by the case, but measure it in pounds when consuming it in production.

This gives the user the ability to record quantities in different unit amounts, depending on the circumstances. For example, you might purchase a raw material by the case, but measure it in pounds when consuming it in production.